Starting out as a beginner in any industry can be difficult. However, I have realized that once you are familiar with the “lingo,” you can relate better and will catch up so fast. That’s why I have curated different crypto slang Nigerians should know before trading.

The crypto space moves fast, and traders use all kinds of shorthand and slang that can leave you confused as a new starter. You’ll hear terms like “HODL,” “FOMO,” or “whales” and wonder if people are speaking in code.

Well, in this post, we’ll break down the most common crypto slang terms every Nigerian trader should understand. Whether you’re buying, selling, or just trying to follow crypto conversations online, this guide will help you understand what different trading slang means.

Why Understanding Crypto Slang Matters

If you have ever scrolled through a crypto group chat or X (Twitter) thread and felt like everyone was speaking another language, you are not alone. The crypto community has its own slang, as it blends humor, tech jargon, and insider terms. However, understanding these terms isn’t just about sounding smart. It can actually help you make better trading decisions.

Fig. 1 – All you need to know about Stablecoins.

When you understand crypto slang;

- You stay informed.

- You understand the terms and can respond appropriately.

- You build confidence in trading.

- You connect better with others in the global community.

Once you learn it, everything starts to make more sense.

Common Crypto Slang Every Nigerian Trader Should Know

Here are common crypto slang terms every Nigerian trader should know;

Fig. 2 – Crypto Airdrop scams: 5 red flags to watch out for 2025.

- HODL

Originally a misspelling of the word “hold,” HODL means to keep your crypto instead of selling, even when the market is down. It’s basically saying, “I believe this coin will bounce back, so I’m holding tight.” The slang shows that the trader is not panicking despite market dips. Since crypto prices often fluctuate, they’re playing the long game and hoping to sell when the price increases.

- To the Moon

Crypto is all about the hype. Hence, the expression “to the moon” means a coin’s price is expected to rise massively. In one sentence, it expresses traders’ excitement about a coin’s growth potential to generate serious money.

- Bear Market/Bull Market

These are two of the most common terms you’ll hear in the crypto world, and they describe the overall mood of the market.

A bear market occurs when prices consistently decline over time, and most traders lose confidence. Major signs are red charts and panic selling. A bull market, on the other hand, is the total opposite. This market is marked by increased prices and profits.

- Bagholder

A bag holder is someone still holding coins after their value has crashed, hoping they will recover someday. Sometimes, that recovery never happens. If you are not careful with research, you could end up holding a “bag” that’s worth almost nothing.

- FOMO (Fear of Missing Out)

This is that feeling you get when a coin’s price is skyrocketing, and everyone’s tweeting “to the moon!” You don’t want to miss out, so you rush to buy the cryptocurrency. FOMO is one of the quickest ways to lose money in crypto. However, a smart trader always thinks before reacting.

- FUD (Fear, Uncertainty, and Doubt)

As the name implies, this is when negative news spreads and makes traders panic-sell. Some large investors even use FUD to manipulate the market. So, they spread fear to drive prices down, then buy at a lower price.

The easiest solution is to always verify the news before reacting. If credible sources do not attest to the news, it is better to avoid panic trading.

- Pump and Dump

This is a scheme where traders hype a coin to drive up its price. This process is known as a pump. Then, they can suddenly sell off the coin and leave late buyers with losses. This process is known as a dump.

If a coin is trending for no clear reason, be careful. It might be a pump-and-dump situation.

- Gas Fees

Gas fees are simply the transaction charges you pay when you send, receive, or trade crypto on certain blockchains like Ethereum or Bitcoin. They are like a bank transfer charge for the network itself. These fees are paid to the individuals who process and confirm your transaction on the blockchain.

The busier the blockchain, the higher the gas fee. During peak trading hours or when everyone is rushing to buy a trending token, gas fees can shoot up and even exceed the value of the transaction itself.

- DYOR (Do Your Own Research)

This is one of the most important phrases in crypto. It’s a reminder that you shouldn’t just follow hype or influencers. Always study the project, the team, and the market before investing.

- Whale

A “whale” is someone (or a group) who owns a large amount of a cryptocurrency. Their actions can largely impact the market. When they buy, prices rise; when they sell, prices crash.

In short, whales are the “big players,” while regular traders like us are just hopeful that whale activity will always be in our favor.

Nigerian Crypto Slang You’ll Hear Online

If we want to come home to Nigeria, here are some crypto slangs you will hear in a Nigerian crypto community;

- “Crypto don red” – This means the person’s wallet is at a loss.

- “I wan cash out” – You’re taking profit.

- “E choke!” – When your portfolio skyrockets.

- “Abeg, who get signal?” – Looking for trade tips or insider info.

- “I no wan collect woto-woto” – Avoiding risky trades.

While there is more crypto slang Nigerians use online, you will become more familiar with it as you interact more with your crypto community.

How Ridima Helps The Nigerian Crypto Community

Everyone knows Ridima is the best place to trade your cryptocurrencies in Nigeria. Millions of customers can attest to the quality of their service, mouth-watering rates, instant payout, and easy process.

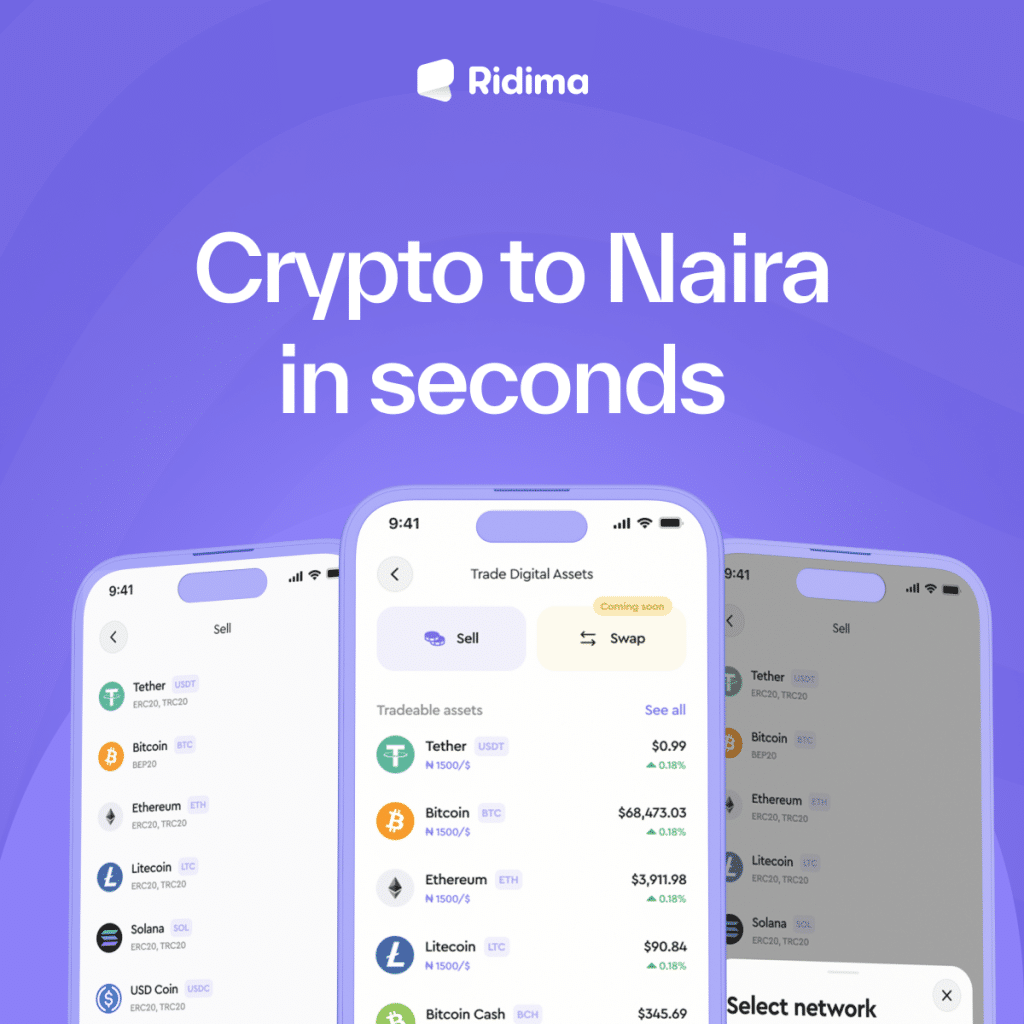

Fig. 3 – Crypto to Naira in seconds: Ridima’s groundbreaking new feature.

See how to sell your cryptocurrencies, using USDT as an example, on Ridima.

- Download the Ridima App from the App Store or the Play Store.

- Open the Ridima App.

- Go to the menu on the app.

- Click on the Trade Digital Assets button.

- Click on Sell and indicate the cryptocurrency you want to exchange.

- In this case, choose USDT as the cryptocurrency.

- Generate your permanent wallet address (This is a one-time action for all future actions).

- View the current exchange rate to know the worth of your USDT.

- Confirm if you are satisfied with the rate.

- Upon satisfaction, send your cryptocurrency from your external wallet to the newly generated Ridima wallet address.

- Wait for our three security confirmation processes to be completed. This process can take a few minutes to ensure optimum accuracy and security of your transaction.

- Upon confirmation, you will receive the Naira equivalent of your transaction in your Ridima Naira wallet.

- You can withdraw Naira or settle your bills via the Ridima app.

Conclusion.

Understanding crypto slang extends from joining the conversation to becoming a smarter trader. Once you understand these terms, you will find it easier to follow trends, identify potential red flags, and make better trading decisions.

The crypto space moves fast, but with the right knowledge and the right platform, such as Ridima, you can trade confidently and safely. So, keep learning and stay alert to earn more and make fewer mistakes.

How to instantly sell Solana in Nigeria

Crypto airdrop scams and 5 red flags to watch out

Top 5 ways to convert bitcoin to naira

How to use an AMEX gift card to make payments on Amazon

How much is 1 dollar bitcoin in naira today

Best app to convert Bitcoin to Naira

Is cryptocurrency different from Bitcoin?

All you need to know about Ridima trading digital assets

Crypto to naira in seconds: Ridima’s groundbreaking new feature

Ridima Just Added Solana: Here’s How to Cash Out Your Solana (SOL) in Nigeria.

Crypto 101: An Explanation of Crypto Glossary For Beginners.